The Case for Investing in Agriculture: A 2024 Perspective

The global agricultural sector, often overlooked by investors, presents a compelling investment opportunity in 2024. The sector's resilience to economic cycles, driven by the ever-present need for food, coupled with the potential for significant growth due to rising global populations and changing dietary habits, makes it an attractive prospect for portfolio diversification and long-term gains.

The Ever-Growing Demand for Food

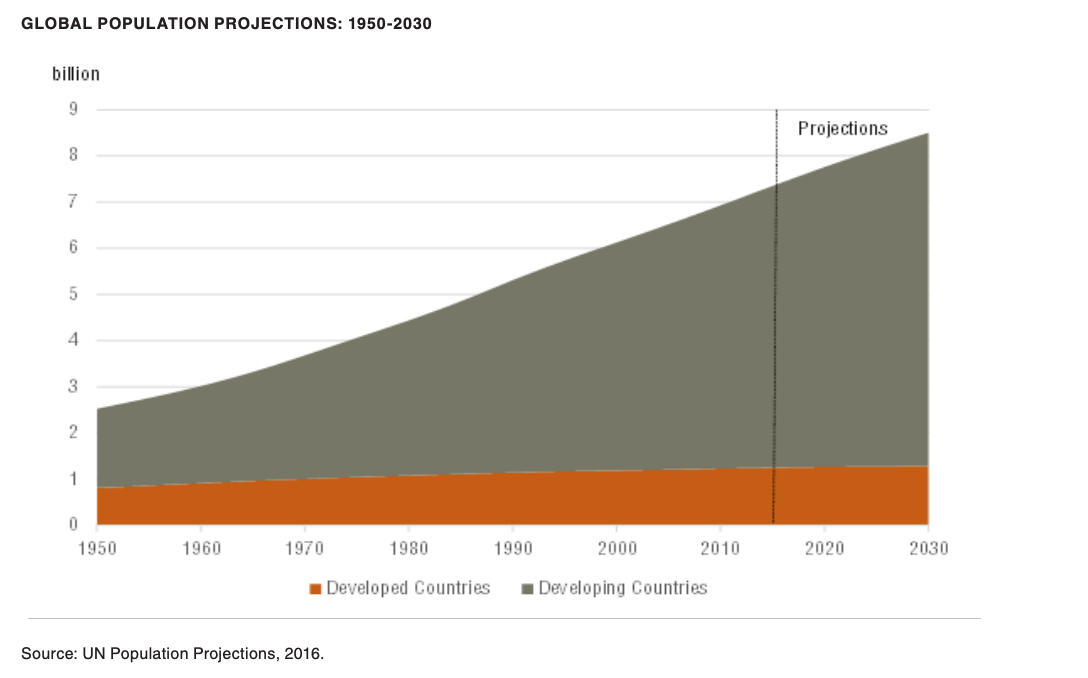

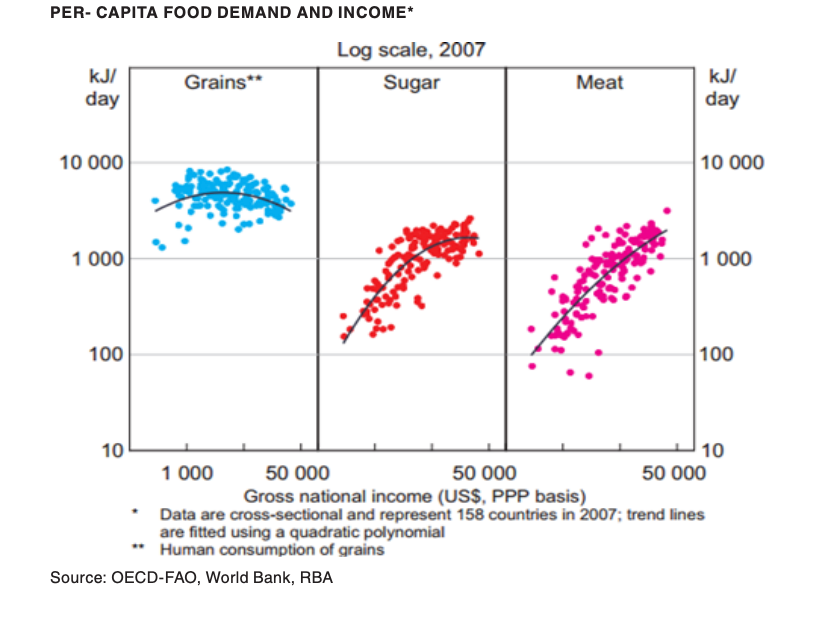

The world's population reached 8 billion in 2023 and is projected to reach 10 billion in 2024, and this continuous growth, primarily in developing nations, translates to an increasing number of mouths to feed. The correlation between rising income levels and increased food consumption, particularly of protein-rich foods like meat and dairy, further amplifies the demand for agricultural products. The growing biofuel industry, especially with the current focus on renewable energy sources, adds another layer to this demand.

The Price Volatility and Growth Potential of Agriculture

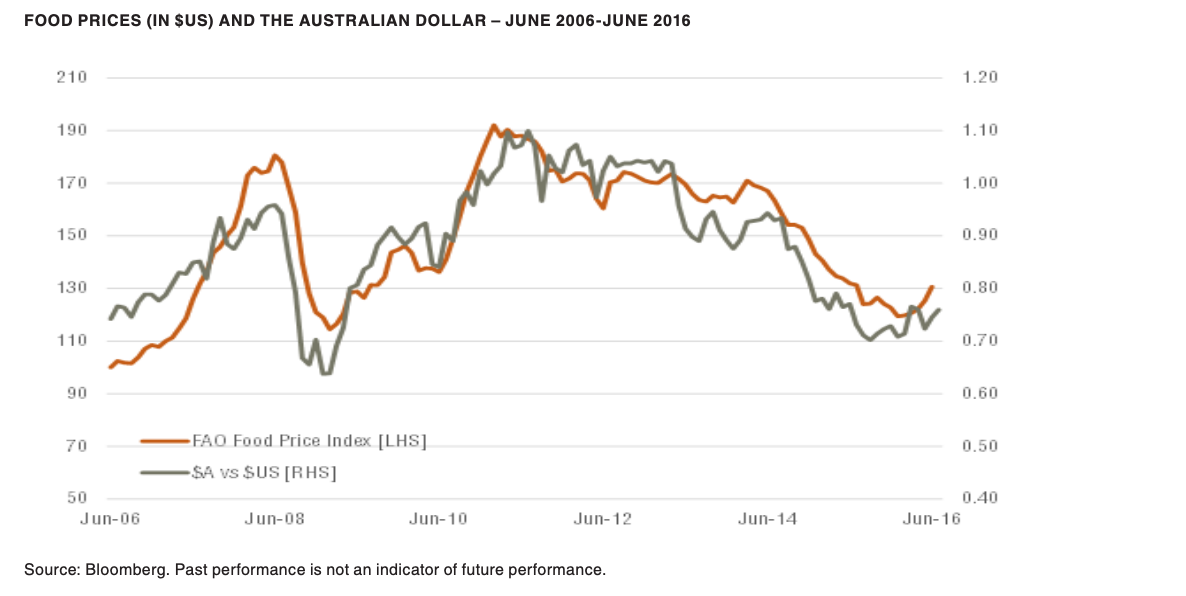

Agricultural prices, though historically volatile due to weather-related supply fluctuations, have shown an upward trend in recent years. The current geopolitical tensions and climate change-induced extreme weather events have further exacerbated this volatility, creating both challenges and opportunities for investors. The possibility of supply disruptions and price spikes, while posing a risk, also presents the potential for substantial returns.

Investing in Agriculture: The Modern Approach

Gone are the days when investing in agriculture meant owning farmland or directly trading in commodity futures. Today, Exchange Traded Funds (ETFs) offer a convenient and accessible way to gain exposure to the agricultural sector. These funds provide diversified exposure to a basket of agricultural commodities or companies, mitigating the risks associated with individual stocks or commodities.

The Benefits of Diversification

The low correlation between agricultural investments and traditional asset classes like equities and bonds makes them a valuable tool for portfolio diversification. The inclusion of agricultural ETFs in a portfolio can potentially enhance risk-adjusted returns by reducing overall portfolio volatility. The BetaShares Global Agriculture Companies ETF, for instance, offers exposure to leading global agricultural firms, providing a diversified investment avenue.

Currency Hedging: A Crucial Consideration

For investors in regions like Australia, where the currency is closely tied to commodity prices, currency hedging becomes crucial when investing in agriculture. Currency-hedged ETFs ensure that investment performance is primarily driven by the underlying agricultural assets, not currency fluctuations.

2024 and Beyond: The Agricultural Outlook

The agricultural sector in 2024 is at a crossroads. On one hand, the growing global population and evolving dietary habits present a strong case for long-term growth. On the other hand, the challenges posed by climate change, geopolitical tensions, and supply chain disruptions cannot be ignored. However, these challenges also create opportunities for astute investors.

The increasing focus on sustainable agriculture and food security further strengthens the sector's prospects. Technological advancements in agriculture, such as precision farming and vertical farming, are also expected to play a crucial role in meeting the growing demand for food while minimising environmental impact.

Conclusion

Investing in agriculture in 2024 is not just about capitalizing on the growing demand for food; it's also about contributing to a sustainable future. The sector's resilience, growth potential, and diversification benefits make it a compelling addition to any investment portfolio. With the advent of agricultural ETFs, investing in this vital sector has never been easier or more accessible. As the world grapples with the challenges of feeding a growing population sustainably, the agricultural sector stands out as a beacon of opportunity and resilience.

Examples of Agricultural Investments in 2024 and more that you’ll find out on Highstreet farmer

- Investing in Agricultural Technology Companies: Companies developing innovative solutions for sustainable agriculture, such as precision farming technologies, vertical farming systems, and agricultural drones, present an exciting investment opportunity.

- Investing in Water Management Companies: With water scarcity becoming a pressing global issue, companies involved in efficient irrigation systems, water conservation technologies, and desalination projects are likely to see increased demand for their services.

- Investing in Sustainable Food Production Companies: Companies focusing on organic farming, plant-based proteins, and sustainable aquaculture offer exposure to the growing consumer preference for ethically and environmentally responsible food choices.

Remember, investing always involves risks, and the agricultural sector is no exception. It's crucial to conduct thorough research, consider your investment goals and risk tolerance, and seek professional advice before making any investment decisions. The information on this website is limited to factual information or (at most) general financial advice only. That means the information and advice do not take into account your objectives, financial situation or needs. It is not specific to you, your needs, goals or objectives. Because of that, you should consider if the advice is appropriate to you and your needs, before acting on the information. If you don’t know what your needs are, you should consult a trusted and licensed financial adviser who can provide you with personal financial product advice. In addition, you should obtain and read the product disclosure statement (PDS) before making a decision to acquire a financial product